The Decentralized Insurance Protocol

InsureDAO is the Insurance platform for Smart-Contract vulnerability risks. The protocol are controlled by the $INSURE token stakers.

Governance

Covers & Pools

InsureDAO for Protocols (Coming soon) ↗

Insurance is the masterpiece of DeFi scalability - we stabilize the entire ecosystem

What makes InsureDAO different is our ability to handle everything from creating and selling insurance, to managing surplus funds. We enable DeFi protocols to easily provide full-featured insurance services to users, whilst ensuring maximum returns for our underwriters.

Buyers

Get covered everywhere you go

With our simple user interface and user experience, anyone can operate InsureDAO to purchase a wide variety of insurance policies at any time.

We offer a range of insurance products, which use dynamic pricing in the calculation of premiums to prevent sellouts.

- Friendly UIX

- Wide range of products

- Available anytime

Underwriters

Support trustworthy projects and profit

InsureDAO enables underwriters to provide liquidity where they want, leverage their funds and adjust their risk.

Additionally, we invest the locked funds in the best lending protocol, allowing you to receive; the premiums of the insurance buyer, the INSURE token, and the investment profits.

- Adjustable risk and return

- $INSURE token incentives

- Maximize capital efficiency

Protocols

Make your protocol secure & reliable

InsureDAO provides full-featured insurance services, that can be easily integrated into any DeFi protocol.

It allows every DeFI protocol to begin offering its own insurance services immediately, allowing your users to feel secure and confident in their investments.

- Free creation

- Quick integration

- No management costs

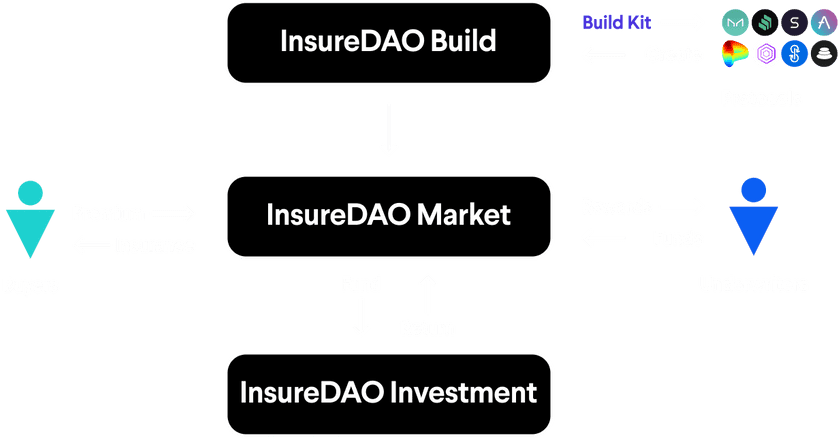

How it all works?

InsureDAO provides three functions:

- InsureDAO Build

- InsureDAO Market

- InsureDAO Investments

Roadmap

Backed by:

Partner with:

Audit and Verified:

Meet the team

Kohshi Shiba

Founder / Developer

Shun Oikawa

Co-founder / Lead Developer

Rubio Kishigami

Co-founder / Business Development

Motoki Takahashi

Co-founder / Marketing

Yuji Yamaguchi

Frontend Developer

Hiroki Kitano (Hirory)

Researcher

Taishi

Product Lead

yamapyblack

Sr. Smart Contracts Developer

Ryota Yamaguchi

Smart Contracts Developer